How do real estate agent commissions work?

When I first started working in real estate, I had to get used to the fact that I’d have to talk about how I get paid all the time. In my previous career in corporate tech, salary and compensation never felt like topics to be openly discussed outside of hiring interviews and performance reviews. When I became a realtor, I realized agent commissions are a hot topic for everyone, real estate professionals and consumers alike. Real estate commissions can be confusing, so let’s break it down.

In real estate, sales commissions are the primary, and oftentimes only, compensation earned by real estate agents. Earnings are based on sales, and agents typically don’t get paid unless a sale closes. (Some real estate agents are salaried, i.e. Redfin agents, but most agents must close sales to earn any income.)

That said, a real estate agent’s income fluctuates based on their client’s needs and timelines. An agent could work with a client for weeks, months, or years before they close a sale – IF they close. Almost every agent I know has had the misfortune of a client or sale not panning out; it’s a risk of doing business. There have been times when I’ve worked with a buyer client for years before we found the right property. Sometimes the stars align and my client lands the first house they make an offer on. In either scenario, I don’t earn a commission until escrow closes on that property.

Commissions: Amounts and splits

Typically a real estate commission is 5% to 6% of the home’s sale price, though commissions are always negotiable. In Santa Clara County, I’ve observed total commissions as low as 4% (i.e. discount brokers) to as high as 10% of the sale price (i.e. land sales, highly unique properties). In real estate transactions, the commissions are paid out to the listing side and split with the buying side.

First, let’s get some terms out of the way. For simplicity, we’ll use the term broker and brokerage interchangeably.

Commissions – the fees paid to real estate brokers and their agents in a real estate transaction

Listing broker – the real estate company or firm under which the listing agent works

Selling/cooperating broker – the real estate company or firm under which the selling agent (buyers agent) works

Listing agent – the real estate professional who represents the seller in the sale

Selling agent (buyers agent) – the real estate professional who represents the buyer in the sale

Between seller and listing broker

The listing agent and the seller agree upon the commission amount at the time of finalizing the listing agreement. The seller pays the commission at close of sale, and the commission is split between the listing broker and the selling/cooperating broker. (Notice I said listing broker and selling broker, not listing agent and selling agent. That’s because every broker-agent commission split is different.) The split is oftentimes 50/50 but not necessarily. In some cases, the seller and listing agent agree on a higher percentage going to the listing side because of the costs associated with listing property. For example, if the total commission is 6% then the listing and selling brokers may each get 3% (50/50 split) or the listing broker may receive 3.5% and the selling broker 2.5% (or some other split adding up to 6%).

Between listing broker and selling/cooperating broker

When the sale closes, the listing broker compensates the selling/cooperating broker with a percentage of the total commission as outlined in the listing agreement. Listing agents disclose these percentage allocations when inputting listings into the MLS. Usually in Santa Clara County, I see 2.5% going to the buy side, but sometimes I’ll see 2%, 2.25%, or 3%. A listing with a lower commission percentage could deter some agents from showing the property just as one with a higher commission might motivate agents. (Ethically speaking, agents should show properties that fit their clients’ criteria, but behavioral economics have proven time and again just how powerful incentives can be.)

Between broker and agent

The listing broker compensates the listing agent at close of sale according to their broker-agent split. A 90/10 split means the agent earns 90% of the commission and the broker earns 10%. Top producing or high volume agents see 90% while most agents see somewhere in the range of 70-80%. These splits vary from brokerage to brokerage and depend on a variety of factors.

That said, if the listing broker receives 3% from a sale, then the agent receives their split percentage of that 3%. The same goes for the selling/cooperating broker and selling (buyers) agent. If the selling broker receives 2.5% from a sale, then the agent receives their split percentage of that 2.5%.

Between selling agent (buyers agent) and buyer

The buyer does not pay the selling agent (buyers agent) a commission as part of a home purchase, though the buyer does need to pay closing costs. The seller pays the real estate commissions. Of course, the buyer and their agent can always negotiate a separate fee or bonus for superb service (the same goes for the seller and their agent).

What if the same agent represents both seller and buyer?

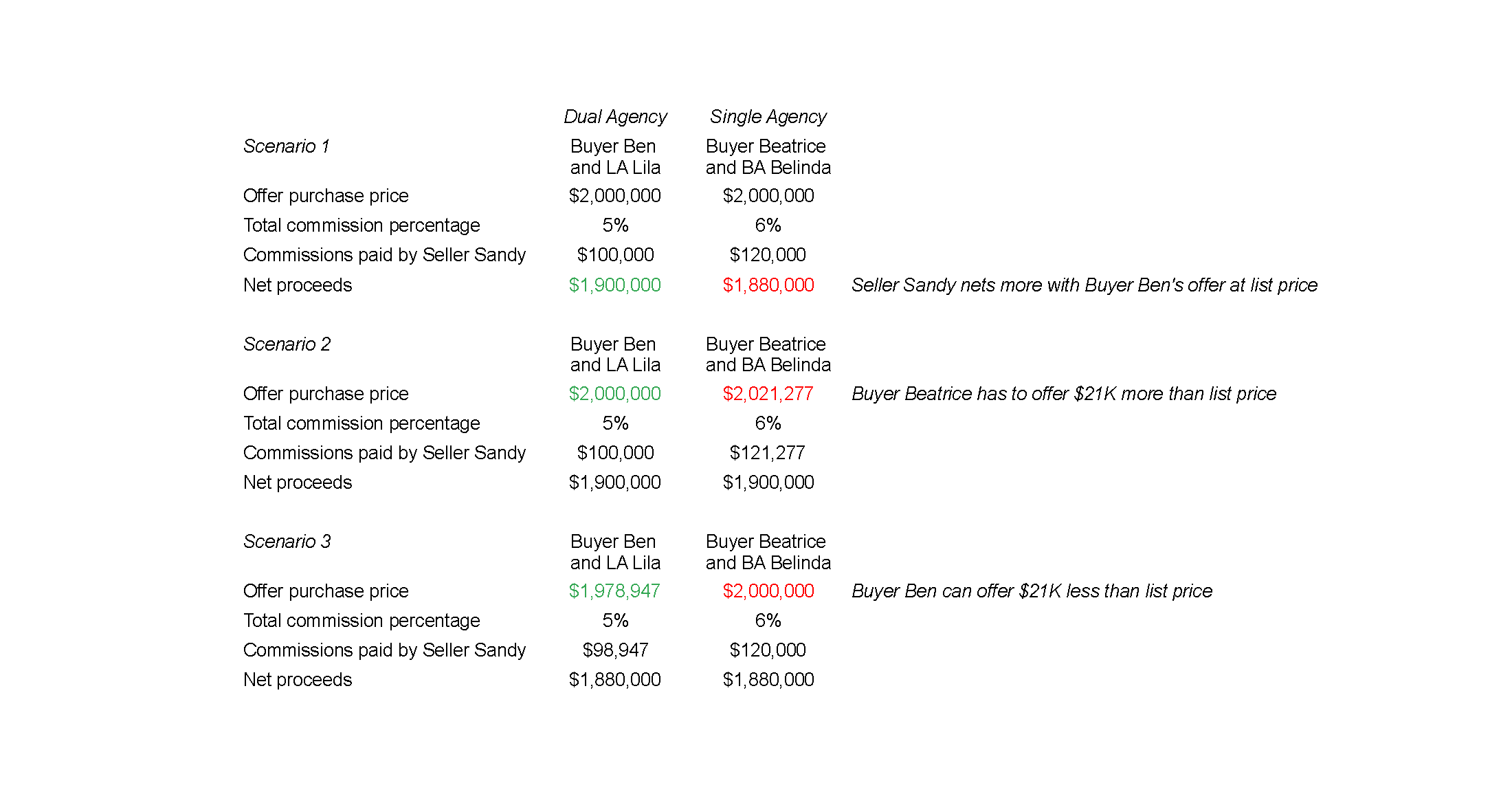

In this dual-agency scenario, the listing broker earns the total commission. Sometimes the seller and listing agent agree to a specialized commission rate in anticipation of this situation. For more reading on this topic, see my post on variable/dual rate commissions.

Now for some commissions math

Let’s take an example of a property listing in which the seller and listing agent agree on a total commission of 6%, split 50/50 between listing broker and selling/cooperating broker. The property sells for $2,000,000. The total commission comes out to be $120,000 (6%).

The listing broker and selling/cooperating broker each make $60,000 (3%). For this example, we’ll say the listing agent stands to make 85% of that 3%, so $51,000. The listing broker earns the remaining $9,000. The selling agent (buyers agent) stands to make 70% or $42,000, with the selling broker earning $18,000.

Why agents earn their commissions

Unless you’ve worked in the industry yourself, it might be difficult to imagine all the effort that goes into successful real estate sales. So much happens behind the scenes, not just the work itself but also the costs. Every real estate agent is working for themselves, running their own small business. Just like any other small business, there are baseline costs to keeping the lights on. Additionally, we have industry- and brokerage-specific costs to cover: license fees, office fees, association fees, MLS fees, transaction coordination fees. Because of the constantly changing environment, we invest in continuing education, training, networking, industry events, and conferences. Many agents invest in software and marketing tools to enhance various aspects of the client experience.

Successful realtors invest heavily in the client experience

In addition to expertise, the greatest value I provide to clients is the time I spend with them throughout the entire sales or purchase process. Clients have access to me and the critical resources necessary to stay informed and make smart decisions. I’m always scanning and gathering data to stay on top of the trends so I can give my clients every advantage. Most clients work 9-5 schedules, which means I often meet with them during evenings and weekends.

In addition to time investment, each transaction incurs specific financial costs, too. When I take on a listing, I cover many costs associated with marketing and advertising the property. Here’s a shortlist: photography, videography, 3D virtual tours, floor plans, digital marketing (social media, emails), physical marketing (flyers, mailers), broker tours, and open houses. There may be other costs I incur upfront and get reimbursed after closing, such as staging, cleaning, painting/repairs.

With buyer clients, I invest large chunks of time previewing and showing properties. I get to know the listing side if I’m not already acquainted. If my clients want to explore a property’s potential or upside, I offer design ideas and vendor referrals. I carefully pore through disclosures and other documents to ensure my clients can be as informed as possible prior to making a purchase decision.

From negotiating the best price and terms to overseeing the transaction through closing, I advocate for my clients until they have keys in hand or see money in the bank. Even after closing, I make myself available to assist with post-transaction tasks, such as referring movers, cleaners, contractors, or property managers. Work with me and you get real estate guidance for life.

Successful clients work with savvy realtors

As people say, the devil’s in the details, and there are so many details involved with a real estate transaction. The right information can make or break a deal. When your realtor knows what information to look (out) for, how to obtain it, and how to use it to your advantage in negotiations, you know they’re earning their keep. Working with a skilled realtor with strong business acumen and intuition means you can save money and time, avoid regret, and have peace of mind.

My clients know the value of working with a competent and responsive realtor. They realize the value in their net proceeds from the sale, in the smoothness or swiftness of escrow. Perhaps, most importantly, they feel it in the joy of having achieved their real estate goal.

Want to experience the value I can add to your home sale or purchase? Contact me or email me at fsun@intero.com for a consultation.

Is the housing market going to crash like it did in 2008?

Ever since I got into real estate practically every client has asked me, “Are we in a housing bubble? When is it going to burst? Is the housing market going to crash like it did in 2008?” It’s kind of like the other scary, looming question Californians throw around at work happy hours: “Aren’t we overdue for a huge earthquake? When is that going to happen?” We shrug, knock on wood, and nervously laugh before moving on to the next, more comfortable topic.

It makes sense to wonder if we’ve had it too good for too long. And when the mortgage interest rate hit 6% last week—the highest it’s been since 2008—you better bet the housing market crash question is back on the table.

But the sky is not falling. Yet. And I’m going to argue that it’s not going to spiral out of control like it did in 2008.

The housing market has come a long way since 2008

Today’s economic conditions differ markedly from the conditions that led to the Great Recession. While the higher inflation and interest rates feel a bit like déjà vu, more stringent lending practices should prevent mass defaults and foreclosures. (For a refresher on the events of 2008, check out this Investopedia article.)

In the SF Bay Area, homeowners have the additional protection of strong tech incomes and even stronger home appreciation. Case in point: If you’ve been stalking your home estimate on Redfin or Zillow, you’ve probably noticed that your property hasn’t dropped in value. That’s because current sale prices are indeed decelerating, but not at a pace that would result in dramatic price depreciation over time.

Homeowners are less likely to default in today’s climate

Homes have appreciated a lot in the last few years, so today’s homeowners have built up a lot of equity. Basically, their property values are higher than what they owe to their banks. They’re not at risk of having their biggest asset/investment go underwater. And in the event of a worst-case scenario, equity-positive homeowners could sell their properties, pay off their mortgages with the sales proceeds, and move on relatively unscathed.

With mortgage underwriting being much more stringent now than it used to be in the notorious subprime days, fewer homeowners will find themselves in desperate situations. Lenders imposed more requirements on buyers post-2008, which means buyers of recent years were truly qualified for their loans. Additionally, these buyers opted for fixed-rate mortgages over riskier ARMs. Riskier mortgages make up a smaller percentage of all mortgages today – 10% are ARMs in 2022 vs. 30% back in 2005-2008.

The housing shortage keeps buyer demand and prices afloat

Housing inventory is at an all-time low as builders have failed to keep up with historical building trends for the past 20 years. According to the National Association of Realtors, the total shortfall could be 6.8 million units. So there are way too few homes for sale and too many people wanting to buy. It’s simple economics—when you have too little supply and too much demand, prices can’t help but rise.

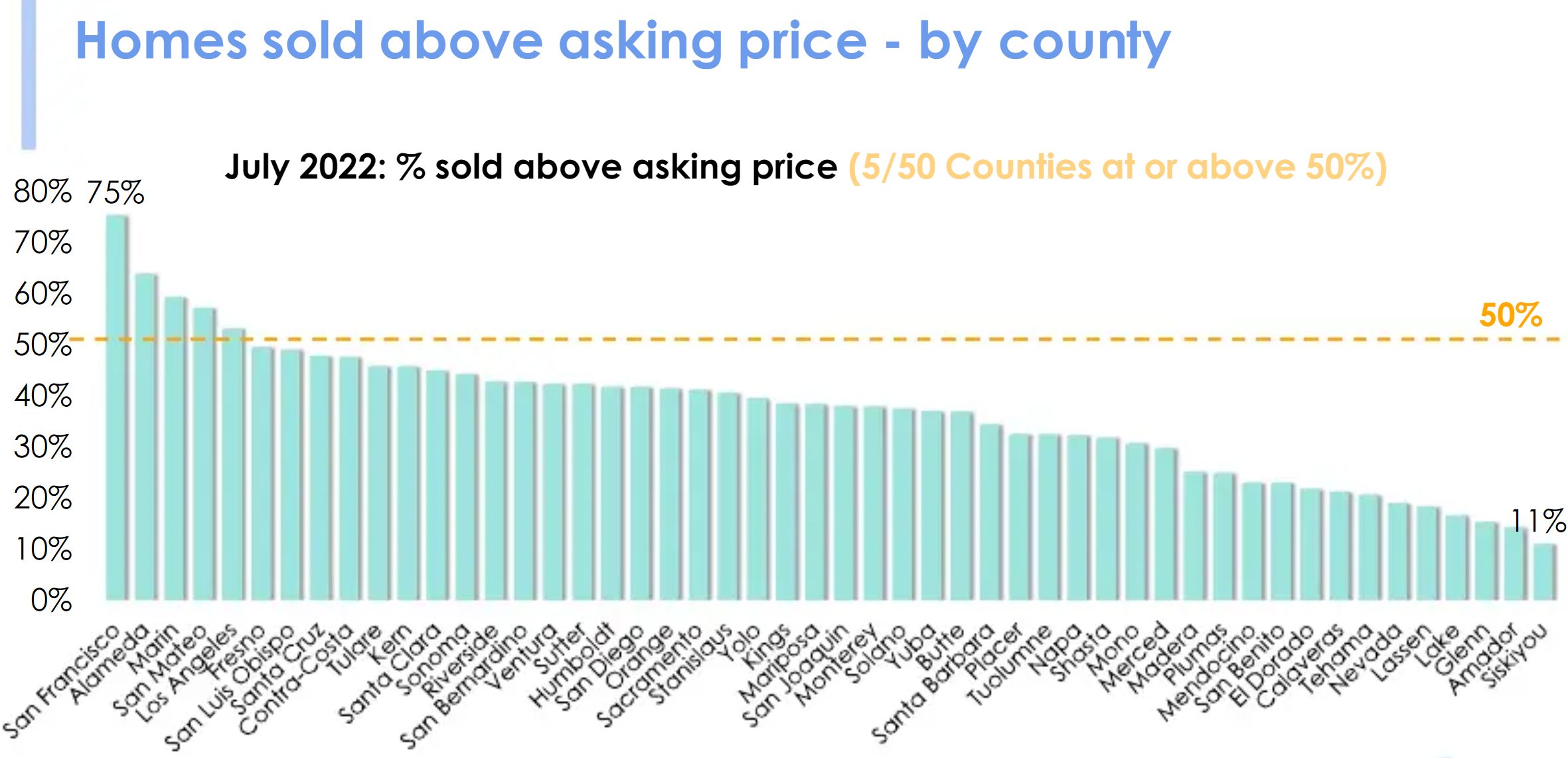

Soaring interest rates have definitely helped curb demand, but the decline in demand won’t come close to offsetting inventory supply. So we’ll expect home sales to slow and prices to adjust, but prices won’t plummet.

Since 2008, housing supply has been on a steady decline while home prices have gone up. Source: Federal Reserve Economic Data, “Alleviating Supply Constraints in the Housing Market” by The White House

Factors to monitor closely in uncertain times

Struggling industries and unemployment.

As things currently stand, I’m not worried about the housing market tanking the economy. I’m more worried about the effects increasing inflation has on the costs of doing business across industries—and the downward spiral that could cause. If companies resort to massive layoffs for cost-cutting, then all that job loss coupled with increased living costs could lead to homeowners defaulting. Currently, the unemployment rate is quite low at 3.7% (back in July it hit a record low of 3.5%). If this number goes up along with interest rates, then I’d be wary of homeowners’ ability to make their monthly payments. We could see an increase in short sales and foreclosures. And if there’s not enough buyer demand to meet the new influx of housing supply then prices will inevitably fall. Investors flush with cash will undoubtedly take advantage, while the average consumer can only defer their homeownership dreams.

More interest rate hikes and riskier mortgages.

Rising interest rates have already altered the lending landscape in a short amount of time. Fearing being priced out, prospective buyers are considering riskier mortgage options. As of August 2022, over 9% of all mortgage applications were for ARMs, up from 3.3% this same time last year. This becomes concerning if applicants overstretch their budgets and overestimate their future earning power. For example, a homeowner could lock in a low-rate ARM today and then find themselves in a high-rate environment five years later. If they’re not earning significantly more, then they might default at the new rate, leading to foreclosure. We don’t want this scenario to unfold en masse.

Overvalued housing markets.

Foreclosures become more of a hot topic if you purchased or live in one of the nation’s most overvalued housing markets. (Fortunately for us in the SF Bay Area, we didn’t make this list.) In cities that saw a large influx of new residents during the pandemic, homeowners will see prices adjust as relocating buyers rethink moving altogether. In more vulnerable markets, homeowners have high debt compared to income, making them most at risk of foreclosing or selling at a loss.

Tech stocks and hiring freezes.

Bay Area real estate activity is highly correlated to the stock market. Here we have the nation’s most concentrated pool of tech workers. High incomes and stock returns prevent buyers from falling out of the housing market. When stocks nosedive, so do buyers’ appetites for real estate, since much of their purchasing power lies in their portfolios. Our strongest pool of buyers depletes further if tech companies continue tightening their pocketbooks and implementing hiring freezes. With the likes of Meta, Alphabet, Apple, and Microsoft slowing down hiring, we’ll see their respective employees slow down house hunting, too.

Taking all of the above into consideration, I remain cautiously optimistic that the housing market won’t crash like it did in 2008. Even if we do hit an economic downturn, I’m confident in the lessons we learned 14 years ago and trust the safeguards we’ve put in place since then. Let’s hope we don’t have to find out—and if we do (knock on wood)—I sure hope I’m right.

Need help with buying or selling in these uncertain times? Contact me or email fsun@intero.com. Check out my Instagram @francesrealestate for more real estate news and tips!

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link