What is a variable rate commission? Clients never ask this question, but I want you to know the answer.

Per MLSListings,

“A dual or variable rate commission arrangement is one in which the seller agrees to pay a specified commission if the property is sold by the listing broker and a different commission if sold by a cooperating broker, and it must be disclosed in the MLS (7.22) and the amount differential must be disclosed when asked by a cooperating agent.”

More simply put, the seller pays a different commission (i.e. reduced amount) if the listing broker/agent procures the buyer for the sale. This happens in cases of dual agency, when one broker/agent represents both the buyer and seller. Dual agency applies if I, Frances Sun, represent both the buyer and seller. Dual agency also applies if two different Intero agents represent both sides.

Variable rate commissions can put buyers at a disadvantage

Variable commissions incentivize sellers to allow dual agency because they’ll save money on the property sale if the listing agent procures the buyer. That said, buyers with their own agent representation may find themselves in a disadvantageous position in these situations.

Note: A variable commission does not necessitate dual agency, and dual agency does not necessitate a variable commission. Even when a variable commission applies, the listing agent may not procure any buyers, resulting in a typical commission split. A listing agent may still operate as a dual agent under a typical commission structure. If the agent double-ends a deal, then they receive the total commission at the full percentage.

Example: Home sale with variable rate commission

Consider two offers at the same price, one presented by the listing agent (dual agent) and the other by a buyers agent. With the variable commission set at a 1% differential, the seller nets an additional 1% of the purchase price if they accept the dual agent’s offer.

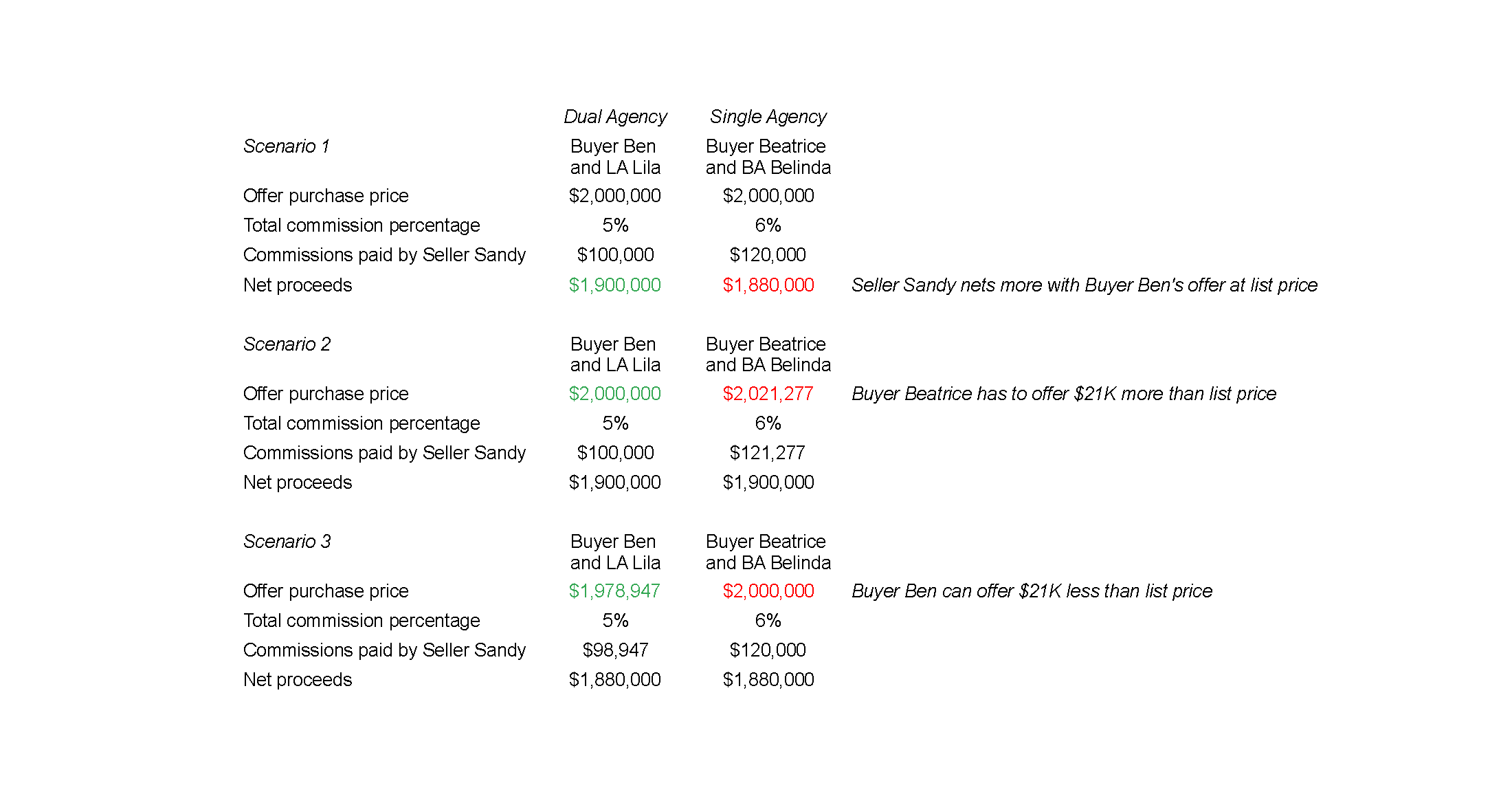

Seller Sandy hires Listing Agent Lila. They decide to list the property for $2,000,000 and enter into a variable rate commission agreement. If LA Lila procures the buyer, then the total commission paid is 5% of the sale price. Otherwise, the total commission paid is 6%.

At the open house, Buyer Ben approaches LA Lila and wants to make an offer at list price. They write up the offer at $2,000,000. If Seller Sandy accepts, she pays a total commission of $100,000 and nets $1,900,000. (For simplicity’s sake, we’ll say no other costs apply.) The full commission goes to LA Lila’s broker.

Buyer Beatrice and her agent, Buyers Agent Belinda, bring an offer at list price, too. However, in this scenario, Seller Sandy pays a total commission of $120,000 (split between LA Lila’s broker and BA Belinda’s broker). Seller Sandy nets $1,880,000—a $20K difference.

All things being equal, for Seller Sandy to choose Buyer Beatrice, Buyer Beatrice would need to beat Buyer Ben’s offer on price and other terms. Buyer Beatrice has to offer $2,021,277 to produce the same net proceeds that Buyer Ben’s lower offer presents Seller Sandy.

Consider two offers at the same price, one presented by the listing agent (dual agent) and the other by a buyers agent. With the variable commission set at a 1% differential, the seller nets an additional 1% of the purchase price if they accept the dual agent’s offer.

Are dual or variable rate commissions fair?

In the above example, you might wonder how a buyer with their own representation could ever win when a variable commission exists. Either you lose the bidding war or you overpay to get the house—sounds less than ideal, right? Why would you even stick with your buyers agent in that scenario? Why not just jump ship and have the listing agent represent you instead?

It’s a tricky situation. If you’re a buyer in love with a property, and a variable commission is in play, working directly with the listing agent could be your best shot at securing the house. But there are no guarantees. In a multiple offer situation, you can’t predict how many competing offers come in or how strong they’ll be. You could be bid up. You could still go up against a buyer who presents a better offer that the seller just can’t refuse.

Variable commissions and dual agency present conflicts of interest

Dual agency and variable commissions are legal in California, as long as brokers/agents properly disclose and get consent. Both can present serious ethical concerns in terms of conflicts of interest. Why? Dual agency generally limits the agent’s ability to negotiate on either client’s behalf. Because a dual agent has the same responsibility to both parties, (whose interests are usually diametrically opposed), the agent realistically cannot advocate fully for either party. When you’re working with a dual agent you can still get fair representation—just don’t expect full representation.

To keep things on the up and up, variable commissions should be established in advance by the seller and listing agent. Also, they should be disclosed to all potential buyers as soon as practical. If a listing agent changes their commission percentage to broker a deal with a buyer, the seller should question the agent’s motivation. Is the listing agent bringing the best offer or just the offer that benefits the listing agent the most?

From the buyer’s point of view, you can’t be certain a dual agent can protect your interests. Chances are, they just met you. Will they take the time to vet the property based on your concerns? Even if they try to remain impartial, they may unwittingly prioritize the interests of the client they’ve known for longer.

Agents have differing views re: dual agency

Some agents operate comfortably as dual agents and others avoid it altogether. As a listing agent, I don’t advocate representing both sides unless it’s likely the only way the deal closes successfully. I always recommend potential buyers to use their own agent if they have one, or I refer them to a trusted colleague if they don’t.

Buyers should be represented by an agent who can truly go to bat for them. Only in rare cases do I believe dual agency can work in favor of all parties. Even if representing both seller and buyer, I don’t adjust my commission percentage. Doing so would provide an unfair and undisclosed advantage to one buyer over other buyers.

Buyers who understand variable commissions make better decisions

Knowing that a dual or variable rate commission exists for a listing can help even the playing field during negotiations. More importantly, knowing the amount differential can help you determine what to offer to be competitive or to move on to the next property.

Your agent should let you know if the listing you’re interested in has a variable rate commission in play. I don’t come across a ton of applicable listings, but for the ones I’ve dealt with, I always keep my clients informed. I make sure we understand the differential and whether the listing agent will be representing buyers. We plot out the various paths to take and how to best position our offer.

Buyers need timely and critical information to make decisions, especially in situations where variable commissions apply. Savvy agents help buyers purchase (or walk away) with confidence.

Do you have a realtor whom you trust to go to bat for you? If not, please contact me or email me at fsun@intero.com to see if I could be that realtor for you.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link